In today’s fast-paced world, managing your finances effectively is more crucial than ever. With the rise of spending tracker apps, individuals can now take control of their financial habits and save more efficiently. This article explores the best finance apps available, focusing on budget trackers and money-saving apps that can help you streamline your spending and enhance your financial well-being.

Understanding Spending Tracker Apps

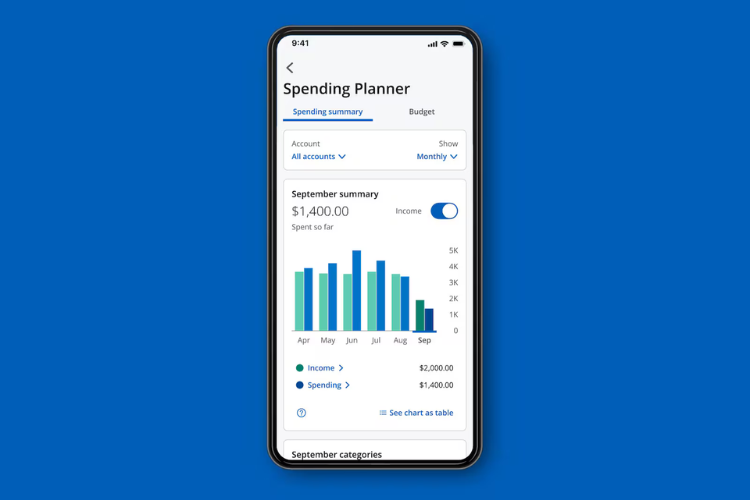

Spending tracker apps are designed to help users monitor their expenses, create budgets, and ultimately save money. These apps provide valuable insights into spending habits and help identify areas where users can cut back. With various features ranging from expense categorization to goal setting, these finance apps are essential tools for anyone looking to improve their financial health.

Key Features of Budget Tracker Apps

When choosing a budget tracker, it’s essential to consider the features that will best suit your needs. Here are some key features to look for:

- Expense Categorization: Helps users categorize their spending for better analysis.

- Budgeting Tools: Allows users to set budgets for different categories and track their progress.

- Goal Setting: Enables users to set financial goals and monitor their progress towards achieving them.

- Integration with Banks: Many apps offer bank integration for automatic transaction tracking.

- Reporting and Analytics: Provides insights into spending patterns through detailed reports.

Top Spending Tracker Apps to Consider

- Mint

- Overview: Mint is one of the most popular finance apps, offering comprehensive budgeting tools and expense tracking.

- Key Features: Automatic bank syncing, bill reminders, and personalized insights.

- Best For: Users looking for a free, all-in-one financial management tool.

- YNAB (You Need A Budget)

- Overview: YNAB focuses on proactive budgeting, giving every dollar a job.

- Key Features: Goal tracking, detailed reports, and educational resources.

- Best For: Individuals who want to take a hands-on approach to budgeting.

- PocketGuard

- Overview: PocketGuard simplifies budgeting by showing how much disposable income you have after bills and expenses.

- Key Features: Automatic expense tracking and personalized savings goals.

- Best For: Users who want a straightforward way to manage their spending.

- GoodBudget

- Overview: GoodBudget uses the envelope budgeting method to help users allocate funds for different spending categories.

- Key Features: Manual entry of expenses and syncing across devices.

- Best For: Individuals who prefer a more traditional budgeting method.

- Personal Capital

- Overview: Personal Capital combines budgeting tools with investment tracking.

- Key Features: Net worth tracking, retirement planning tools, and investment analysis.

- Best For: Users looking to manage both their budgets and investments.

Benefits of Using Money-Saving Apps

Money-saving apps offer numerous benefits that can enhance your financial journey:

- Increased Awareness: By tracking your spending, you become more aware of your financial habits.

- Goal Achievement: Setting and monitoring financial goals becomes easier with dedicated apps.

- Time Savings: Automated tracking saves time and reduces the hassle of manual entry.

- Financial Education: Many apps provide resources and tips to improve your financial literacy.

Five Frequently Asked Questions

What are spending tracker apps?

Spending tracker apps are tools that help users monitor and manage their expenses, set budgets, and achieve financial goals.

Are spending tracker apps free?

Many spending tracker apps offer free versions with basic features, while premium versions provide additional functionalities for a fee.

How do I choose the right budget tracker for me?

Consider your financial goals, preferred budgeting style, and the features that are most important to you when selecting a budget tracker.

Conclusion

In conclusion, spending tracker apps are invaluable tools for anyone looking to manage their finances effectively. By utilizing these finance apps, you can gain insights into your spending habits, set budgets, and work towards your financial goals. Whether you prefer a comprehensive app like Mint or a more focused tool like YNAB, there are plenty of options available to suit your needs.

Start planning your financial future today! Explore the best spending tracker apps and take control of your finances. For more tips, check out our articles on How to Improve Your Credit Score improvement Fast and Passive Income Ideas to Earn Extra Money.

By following these guidelines and utilizing the recommended spending tracker apps, you’ll be well on your way to mastering your finances and saving more effectively.